can cash app report to irs

Rather small business owners independent contractors and those with a. Certain Cash App accounts will receive tax forms for the 2018 tax year.

Cash App Taxes Review Free Straightforward Preparation Service

This is far below the previous threshold of 20K.

/images/2022/02/08/cash-app-and-venmo.jpg)

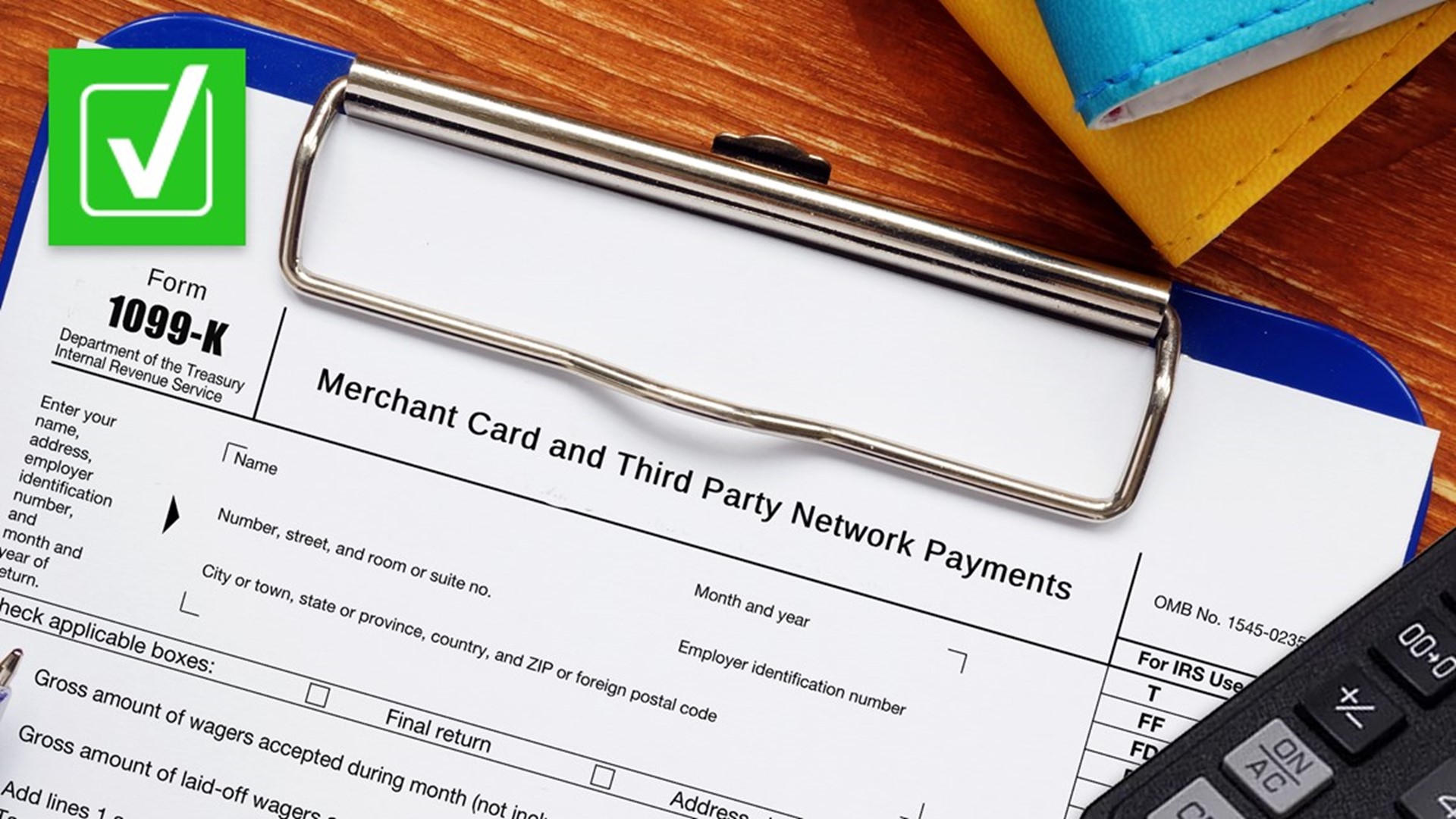

. Beginning this year Cash app networks are required to send a Form 1099-K to any user that meets this income threshold. Some businesses or sellers who receive money through cash apps may not have been reporting all the income. VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. The American Rescue Plan includes a new law that requires cash apps like Venmo and Cash App to report payments of 600 or more to the IRS. Likewise people ask does Cashapp report to IRS.

This new 600 reporting requirement does not apply to personal Cash App accounts. Cash apps like Venmo Zelle and PayPal make paying for certain expenses a breeze but a new IRS rule will require some folks to report. Venmo PayPal and Cash App to report payments of 600 or more to IRS this year.

1250 PM EDT October 16 2021. The new rule which took effect. 1 2022 a provision of the 2021 American Rescue Plan requires earnings over 600 paid through digital apps like PayPal Cash App or Venmo to be reported to the IRS.

The IRS wants to make sure theyre getting their cut of taxes. Thats because the IRS will be keeping a watchful eye on cash app transactions for small businesses. For any additional tax information please reach out to a tax professional or visit the IRS website.

Filers will receive an electronic acknowledgement of each form they file. A person can file Form 8300 electronically using the Financial Crimes Enforcement Networks BSA E-Filing System. As part of the American Rescue Plan Act cash apps will now report commercial income over 600.

Now cash apps are required to report payments totaling more than 600 for goods and services. The IRS wont be cracking down on personal transactions but a new law will require cash apps like Venmo Zelle and Paypal to report aggregate business transactions of 600 or more to the IRS. E-filing is free quick and secure.

Before the new rule business transactions were only. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions. Starting January 1 2022 cash app business transactions of more than 600 will need to be reported to the IRS.

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. What to know Business owners are already required to report these incomes to the IRS. Because the money never went to a bank account keeping it under the IRS radar was easy.

However as of January 2022 all of that will change. Article continues below advertisement Source. Log in to your Cash App Dashboard on web to download your forms.

People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. Log in to your Cash App Dashboard on web to download your forms. 1 2022 users who send or receive more than 600 on cash apps must report those earnings to the IRS.

PayPal and Cash App to report to the IRS on money that goes in and out of accounts with values of at least 600. Some landlords and other small businesses took advantage of this and started using cash apps to collect rent. Certain Cash App accounts will receive tax forms for the 2021 tax year.

By lowering the reporting threshold from 20000 to 600 the IRS will get that transaction information from the cash app platform. So now apps like Cash App will notify the IRS when transactions get up to 600. A copy of the 1099-K will be sent to the IRS.

However the American Rescue Plan made changes to these regulations. For any additional tax information please reach out to a tax professional or visit the IRS website. The IRS wont be cracking down on personal transactions but a new law will require cash apps like Venmo Zelle and Paypal to report aggregate business transactions of 600 or more to the IRS.

Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they exceed 600 annually. An FAQ from the IRS is available here.

If you receive over 600 in yearly income on Venmo Cash App Zelle or PayPal you will receive a Form 1099. Under the original IRS reporting requirements people are already supposed to. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS.

Cash App Support Tax Reporting for Cash App. 1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. CPA Kemberley Washington explains what you need to know.

There isnt any new Cash App tax for 2022. Tax Reporting for Cash App.

Cash App Reviews Read Customer Service Reviews Of Cash App

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Does Cash App Report To The Irs

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Credit Karma Tax Now Cash App Taxes Doctor Of Credit

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com

Cash App Taxes Review Forbes Advisor

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

/images/2022/02/08/cash-app-and-venmo.jpg)

What Venmo And Cash App Users Need To Know About New Tax Rules Financebuzz

Changes To Cash App Reporting Threshold Paypal Venmo More

![]()

Tax Reporting With Cash For Business

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Cash App Review Fees And Limits Explained Finder Com

Cash App Tax Forms All Tax Reporting Information With Cash App

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates